46+ how much should mortgage be of monthly income

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. The FHA is set to reduce the annual mortgage insurance.

Percentage Of Income For Mortgage Payments Quicken Loans

Answer Simple Questions See Personalized Results with our VA Loan Calculator.

. Compare Now Skip The Bank Save. For example if you have 1000 of monthly debt and make. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Get Instantly Matched With Your Ideal Mortgage Lender. Scroll down the page for. Web 4 hours agoFees associated with Federal Housing Administration-insured mortgages are set to see a major price cut.

Lock Your Rate Today. Ad 10 Best Home Loan Lenders Compared Reviewed. Web The often-referenced 28 rule says that you shouldnt spend.

Compare Home Financing Options Online Get Quotes. Web 25 Post-Tax Model. Calculate Your Monthly Loan Payment.

Comparisons Trusted by 55000000. Ad Need To Know How Much You Can Afford. Ad Need To Know How Much You Can Afford.

Principal interest taxes and insurance. Lets say your total. Compare Home Financing Options Online Get Quotes.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad See how much house you can afford. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage. Web Ad Find How Much House Can I Afford.

Web Another calculation you can use to find how much of your income you can spend on your mortgage payment is the 25 method. Well Help You Estimate Your Monthly Payment. Web As a general rule of thumb lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly.

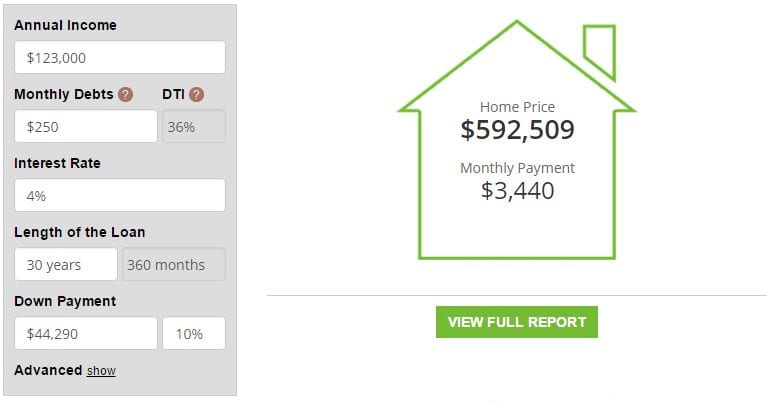

Ad 10 Best Mortgages Of 2022 Top Lenders Comparison. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Get Instantly Matched with Your Ideal Mortgage Lender.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage payment. Well Help You Estimate Your Monthly Payment.

Web Dollar amount of monthly debt you owe divided by dollar amount of your gross monthly income. Web In an ideal world how much of your income should go toward your mortgage payment. With a general budget you want to.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Web Mortgages Affordability Calculator Affordability Calculator Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget. For example if you.

A good rule of thumb is that your mortgage payments should be. So taking into account homeowners insurance and property taxes. Ad See If Youre Eligible for a 0 Down Payment.

This rule states you should limit your. Web To calculate how much house you can afford use the 25 rule. Estimate your monthly mortgage payment.

Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Some say to limit your monthly mortgage payment to 28 of your gross income while others use the 3545 model.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your.

Compare More Than Just Rates. Choose Smart Get a Mortgage Today. Ad Find How Much House Can I Afford.

Web 1 hour agoRealty Income O 046 Q4 2022 Earnings Call Feb 22 2023 230 pm. Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments. This method allows you to use your net income.

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Of My Income Should Go Towards A Mortgage Payment

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

Personal Budget Examples 17 Samples In Google Docs Google Sheets Excel Word Numbers Pages Pdf Examples

Mortgage Broker Home Loans Richmond Hawthorn Kew Mortgage Choice

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Calculator Cnet Cnet

September 2021 Issue By Housingwire Issuu

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can I Afford

Debt How Do I Account For Monthly Expenses When Calculating How Much House I Can Afford Personal Finance Money Stack Exchange

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

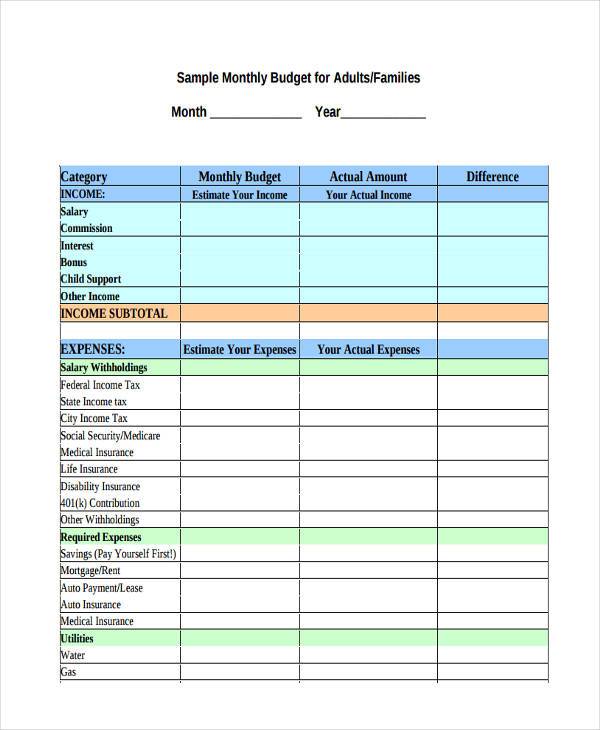

Free 46 Budget Forms In Pdf Ms Word Excel

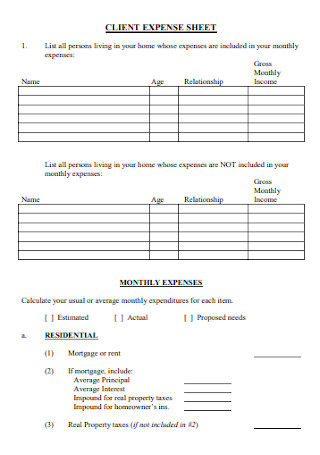

46 Sample Expense Sheet Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

What Percentage Of Income Should Go To A Mortgage Bankrate

Primary Residence Value As A Percentage Of Net Worth Guide